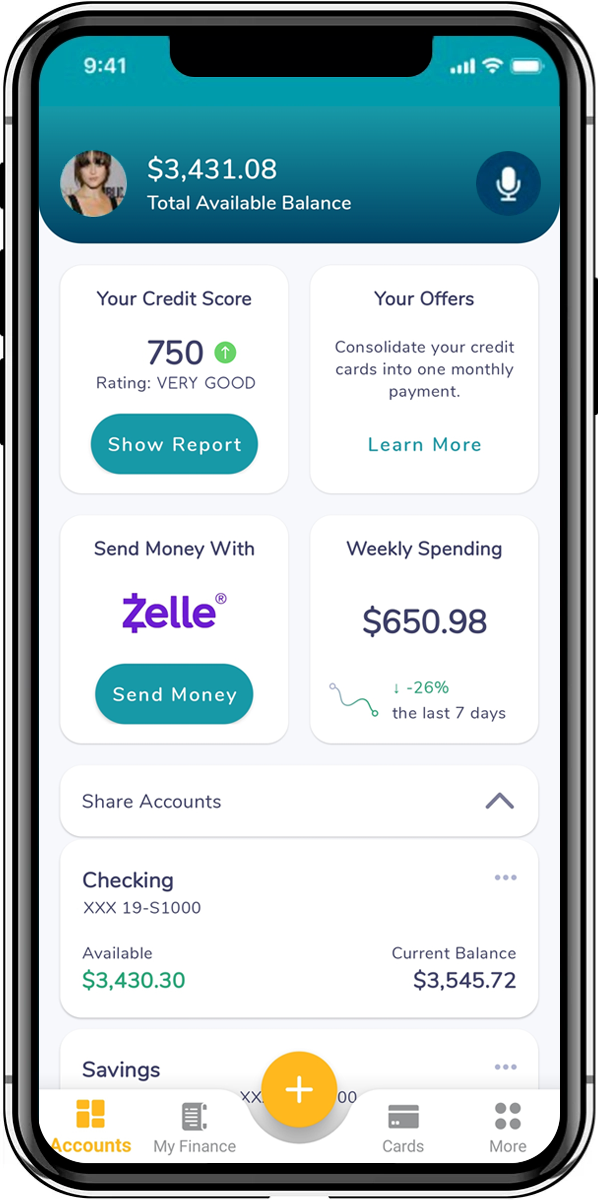

ONLINE & MOBILE SERVICES

Manage your money on the go, any time, with the Pyramid App!

FACE & TOUCH LOGIN

Make transactions easy and secure with Face ID, Touch ID, and Fingerprint Authentication.

PERSONAL INFO UPDATES

Update your personal info, such as address, email, or phone on the go.

DEBIT & CREDIT CARD ON/OFF

Turn off lost or stolen cards immediately, and back on if found.

KNOW NOW WITH ACCOUNT ALERTS

Whoa! What’s this $100 withdrawal? Setup custom alerts sent to your phone or email.

DIGITAL WALLET

Support for your digital wallet, GooglePay, ApplePay, and SamsungPay!

APPLY ONLINE

Apply for a loan right from your phone! Easy and convenient.

ESTATEMENTS

Get up to 24 months of eStatements on your accounts.

REMOTE DEPOSIT

Deposit checks with your mobile device just by taking a picture.

TRANSFER FUNDS

Get it all done on the go. Internal, external, and member-to-member transfers.

We’re continuing to improve the way you bank, giving you anytime digital access to help you take care of your banking needs online, via mobile device, or over the phone - all without leaving your home. Experience Pyramid's enhanced Online and Mobile Banking services by logging in today.

Online Banking

Mobile Banking

Online and Mobile Banking are subject to the Online Banking Services Agreement and Disclosures.